Terms of REPO transactions

| The deal on the client's investment |

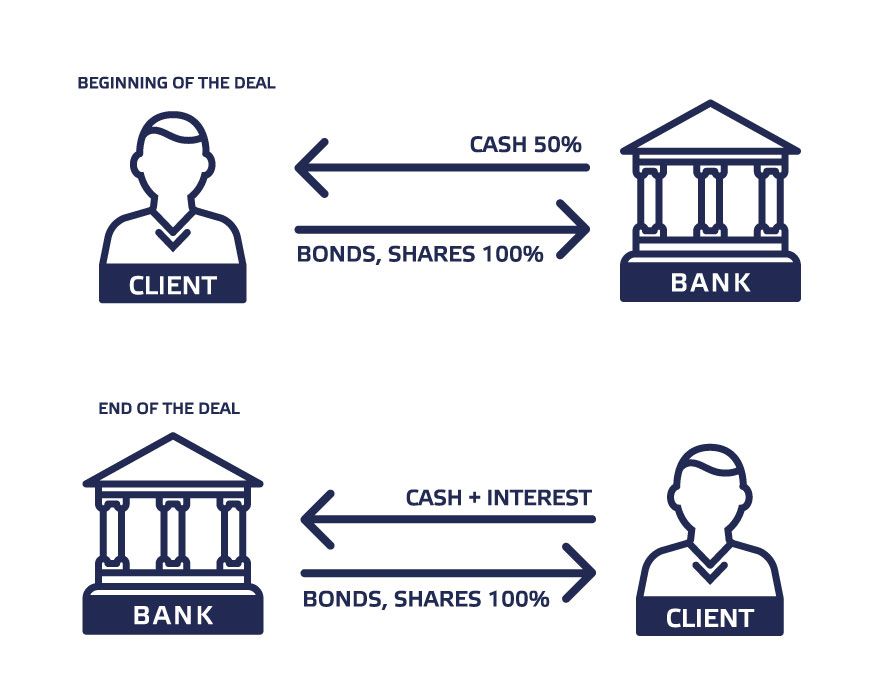

REPO deal |

| Issuer |

Bond A |

Issuer |

Bond A |

| Rating |

BB |

Rating |

BB |

| Maturity |

25.09.2017 |

Maturity |

25.09.2017 |

| Coupon rate |

7.88% |

Coupon rate |

7.88% |

| Price |

100% |

Price |

100% |

| HC |

0% |

HC |

30% |

| Bank credit |

0% |

Bank credit |

70% |

| Trade volume, USD |

300 000 |

Trade volume, USD |

1 000 000 |

| Fee for trade 0.08% |

-240 |

Fee for trade 0.08% |

-800 |

| Bank Loan |

- |

Bank Loan |

700 000 |

| Client's Investment |

300 000 |

Client's Investment |

300 000 |

| Credit rate, % |

|

Credit rate, % |

3.50% |

| Credit fee per year, USD |

- |

Credit fee per year, USD |

(24 500) |

| Coupon per year USD |

23 640 |

Coupon per year USD |

78 800 |

| Client's Profit, USD |

23 640 |

Client's Profit, USD |

53 500 |

| Client's Yield, % * |

7.80% |

Client's Yield, % * |

17.83% |

Marginal lending (provision of leverage)

Performing transactions on the electronic platforms of PNB Banka, the client has an option to use the leverage for transactions with parcticular shares. The counterparty defines the size of the leverage and list of marginal shares. The client will be charged an additional commission for use of the marginal loan.

For more information, please, contact the Brokerage Division of PNB Banka over the telephone +37167011561 or e-mail broker@pnbbanka.eu.